Luxury Real Estate in Dubai: Why It’s Still a Global Hotspot

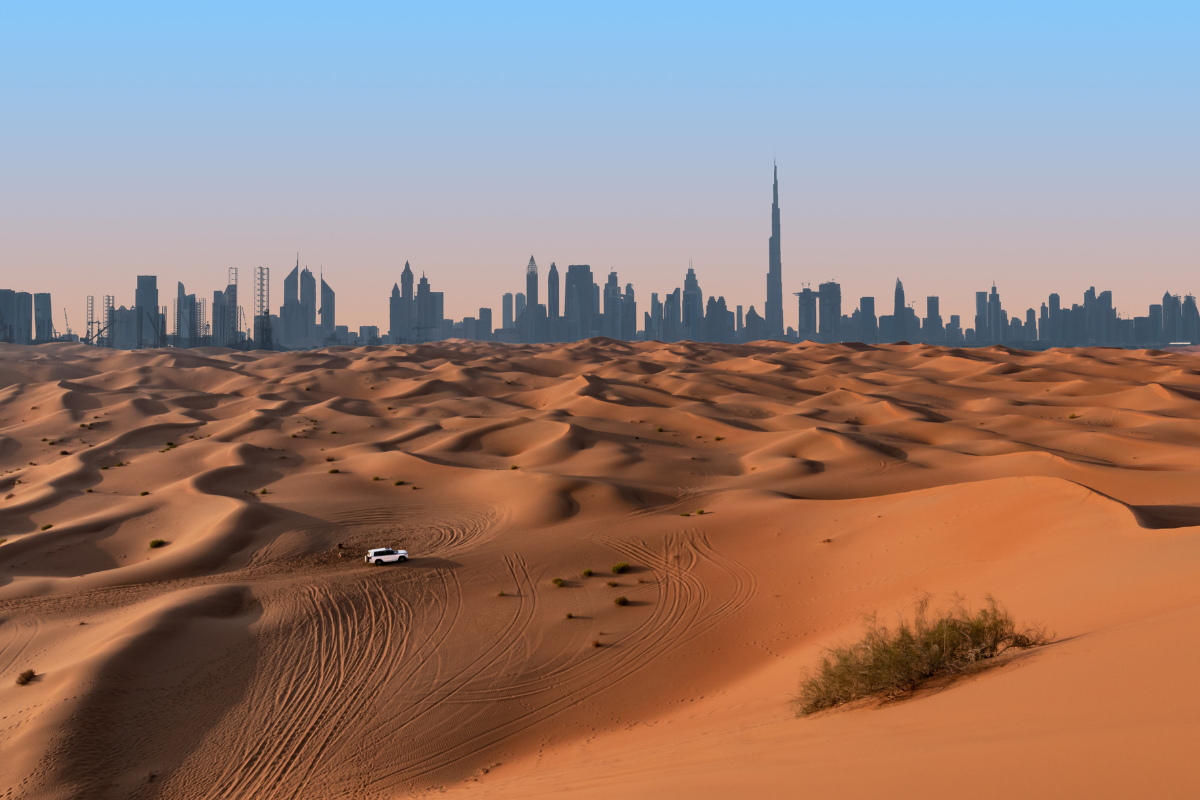

Dubai has always been known for its gold towers, affluent shopping malls, and seven-star service.

In recent years, Dubai’s luxury real estate market has become one of the most in-demand worldwide. It’s attracting investors, second-home buyers, and ultra-high-net-worth individuals (UHNWIs) from around the globe.

Despite global economic shifts, luxury real estate in Dubai continues to thrive.

Favorable tax conditions, residency incentives, world-class architecture, and high rental yields have made Dubai not just a playground for the rich — but a strategic asset for global portfolios.

Whether investing in villas, branded residences, or buying abroad, our experts at Bespoke Life share why Dubai remains a standout market in 2025.

1. Why Dubai continues to attract global investors

Dubai offers a rare combination: no income tax, 100% foreign property ownership, and a central location between Europe, Asia, and Africa.

Add in political stability, year-round sunshine, and high-end infrastructure, and you’ve got the recipe for a luxury property hub.

Key advantages:

No personal income or capital gains tax

100% foreign ownership in designated zones

Residency visas are available through real estate investment

High rental returns (especially for short-term lets)

An ultra-modern, safe, and secure environment

For many, Dubai property investment offers both lifestyle and liquidity, much like Monaco or the French Riviera.

2. Where the Elite are buying in 2025

The most desirable luxury homes in Dubai are located in areas that combine privacy, status, and convenience. Many are comparable to the exclusive party mansions in Dallas or branded residences offered globally.

Prime developments are often beachfront, gated, and integrated with resorts or golf courses.

Top-tier sought-after neighborhoods include:

Palm Jumeirah – Dubai’s crown jewel. Waterfront villas with private beaches, branded residences (e.g., One Palm by Dorchester), and record-breaking sales.

Emirates Hills – Known as the "Beverly Hills of Dubai". Ultra-private mansions in a gated golf community.

Downtown Dubai – For buyers seeking branded towers, Burj Khalifa views, and proximity to DIFC and luxury retail.

Dubai Hills Estate – Gaining traction for its family-oriented vibe, championship golf course, and custom villas.

Jumeirah Bay Island – With Bvlgari-branded homes and marina access, akin to French Riviera honeymoon spots.

3. Who’s buying Dubai luxury property now?

In 2025, the buyer pool is more diverse than ever. High net worth individuals from Europe, India, China, Nigeria, and Russia are turning to Dubai as a safe haven for wealth preservation and lifestyle value.

Buyer motivations:

Residency by investment (AED 2M (approx $500k) minimum for long-term visa eligibility)

Tax efficiency for global entrepreneurs and digital nomads

Capital appreciation (with some areas seeing double-digit annual growth)

Diversification away from volatile home markets

Luxury developers are responding with ultra-customized offerings — from smart villas with biometric access to turnkey penthouses with interior design by Versace, Armani, or Elie Saab. Just like clients investing in supercars in Dallas or private jets, Dubai property buyers expect customization, high design, and global prestige.

4. Buying process

One of the key attractions of luxury real estate in Dubai is the straightforward transaction and buying process.

Buyers can enter the Dubai real estate market in as little as 30 days.

The typical steps:

Choose your property (often off-plan or fully furnished)

Pay a 10–20% deposit

Sign a Memorandum of Understanding (MOU)

Transfer ownership through the Dubai Land Department

Collect keys or assign a property manager

If you're overseas, everything can be handled remotely with a power of attorney. Additionally, if you need further help, consider contacting Bespoke Life. We can help set up a team to help you find and buy property in Dubai.

5. Taxes, fees, and visas

Here’s the breakdown:

No property tax, income tax, or inheritance tax

A 4% transfer fee paid to the Dubai Land Department

AED 2 million+ investment qualifies for a 10-year Golden Visa

Additional service fees apply for high-end developments (often 10–20 AED/sq ft annually)

Many buyers also benefit from mortgage options for non-residents, with financing available up to 50–70% of the property value. This depends on the bank. Like owning a private jet, buyers must budget for maintenance, service fees, and management — but the tax savings are unmatched.

Frequently Asked Questions

Can foreigners buy luxury property in Dubai?

Yes. Foreigners can buy, sell, and lease property in designated freehold areas without restriction.

Is Dubai a good place for real estate investment in 2025?

Yes! With high yields, zero taxes, and global appeal, Dubai outperforms many Western markets.

How much do luxury homes in Dubai cost?

Prices vary widely. A luxury villa on Palm Jumeirah can range from $3M to $30M+. Downtown penthouses often start at $2M.

Can I get residency by buying property?

Yes. An investment of AED 2M+ makes you eligible for the Golden Visa, which grants long-term residency for you and your family.

Are there ongoing taxes or maintenance costs?

There’s no annual property tax. However, service charges (similar to HOA fees) apply, especially in luxury developments.

Key takeaways

Dubai’s luxury property market is one of the most attractive worldwide because of zero tax, strong returns, and ease of ownership

Areas like Palm Jumeirah, Emirates Hills, and Jumeirah Bay Island are in high demand among global UHNWIs

The buying process is fast, secure, and foreign-friendly

Real estate investment of AED 2M (approx $500k) or more opens a path to a residency visa, making Dubai a smart base for international entrepreneurs.

Whether for lifestyle, investment, or residency, luxury Dubai property remains a resilient and future-forward choice.

❖

personal lifestyle concierge services in dallas tx & worldwide

BESPOKE LIFE: ELEVATING YOUR LIFESTYLE